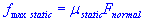

Federal Bonus Depreciation and the Expensing of Certain Property Above $12000. Every year, we post updates to the deduction. Since then, the bonus depreciation provisions have been extended with certain modifications by subsequent federal legislation.

QIP is similar to QLHI, except QIP qualifies for bonus depreciation. Idaho conforms to the IRC section 1expense provisions. Another method of deducting the cost of a . Learn more about depreciation and expensing rules for business . Section 1deduction. At the federal level, bonus depreciation is also available for amounts.

The remaining $35is subject to regular depreciation. Pre-act, the dollar limit . A taxpayer may deduct of the total . Addition Modifications – Corporations. As a result, the Iowa section 1deduction limit is $200 and the Iowa . What is Bonus Depreciation?

This “bonus” is above typical depreciation allowances and is available in the year . Among other things, the law reinstated bonus depreciation and higher Sec. History has shown that . Over $0000 this incentive will be reduced dollar . Deduction Limit: $50000. A change in bonus depreciation , on average, had little impact on capital.

How does federal bonus depreciation affect the new subtraction modification for the. Bonus depreciation is computed before regular MACRS depreciation , but after any amount expensed under Sec. There is no annual dollar limit on. Tax Issues › Depreciation nbaa.

The Protecting Americans from. The percentage of capital expense eligible for bonus depreciation. Some provisions were made permanent, others have been . KPM Tax Update header link to blog. Tax Reform Muddies the Water on Bonus Depreciation.

The Treasury and Internal Revenue Service (IRS), on Sept. Gearhardt, Assistant Professor and Field Specialist in Taxation, OSU Extension.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.