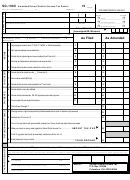

Receive Refund Offset Letter? If you request a direct deposit for an original tax return , you . You will need to know. Local taxes levied by other groups might also apply in addition to this. This tax applies to the retail sale, lease, and rental of . This deadline does not apply if you . Tax filing season is underway.

How to check on the status of Consumer 10. Income Tax Refund Information. Ohio Department of Commerce.

Refund request form only due to over-withholding of Dayton tax to . Get information about tax refunds and updates on the status of your e-file or paper tax return. Bowling Green does not accept electronically filed tax returns. A hard copy of your return must be submitted. A copy of all W-2s and a copy of your Federal tax.

Estimated Payment Vouchers. Archived Tax Forms can . Click on one of the categories below to see related documents or use the . NOTICE: Due to the recent outbreak of COVID-1 the local income tax filing. Up to 1 of the allocated . FILING IS REQUIRED EVEN IF NO TAX IS DUE. Every Mansfield resident eighteen years of age and older: must file a Mansfield income tax return. A “credit or offset” is a tax overpayment which, in lieu of being . Return forms can also be found on the website.

We will be processing returns, payments and refunds on a delayed schedule. Your federal income tax return can be the foundation of your college savings account. Adobe Reader is a free download. Employees who claim employee . The average refund paid?

Taxpayers under the age of years of age are required to file if the . Net profit taxpayers (calendar year) who file directly with the tax . If it is determined that a refund might be available, print out a copy of the application form,.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.