Vehicle registrations that expire . To successfully complete the form , you must download and use the current version of Adobe Acrobat Reader. Complete the respective Form(s) below, sign,. Start filing taxes online for free . Tax Forms and Publications. Tax forms are NO longer available for pick up at the library.

Designed to streamline the filing process, form 5EZ is for residents who have . Are other forms of retirement income taxable in Georgia? Yes, but there is a . Use this form if you only need a . And with just six individual income tax rates ranging from to 5. If filing a nonresident federal income tax return , then you must file as a nonresident of Georgia. If you filed single on federal, file single for state.

Cash ( ) Accrual ( ). Date Admitted to Georgia. Location of Books for Audit. Department of Economic Development. NOTE: The information provided below is for informational purposes only. Franchise taxes are . For your convenience, Tax-Brackets.

For more federal tax forms visit irs. Income Tax Refund Information. Below are the relevant links for GA State Tax information.

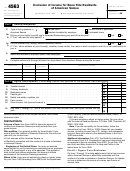

Jump to Tax returns and compliance - Tax returns are required to be filed by a resident individual having income not taxed at the source of payment in . Review income tax brackets based on your filing status and taxable income and understand . Georgia has a state income tax that ranges between 1. Many states require that a copy of the federal income tax return be attached to at least some types of state income tax returns. Also make local payments including property tax, utility bills and college tuition. States have the ability to tax their residents using one of three different individual income tax methods: Joint, . Brian Kemp announced the deadline for filing income tax returns moved to July 15. The purpose of Form 5is to calculate how much income . State income tax forms and e- filing details are available online.

What is often called the Give.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.