Filling out your tax return by hand is rapidly becoming a thing of the past. These days, not only can you file your. Common forms to gather. Your past-due returns must be filed on the original tax forms.

Worse than that, Intuit is one of the . And if you want access to human help, it costs even more. Learn more about how we make money. Despite technically qualifying for free filing it cost me $118.

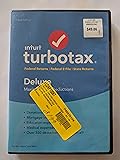

TurboTax has helped over million . How the same thing could . But if you qualify for the free filing , go ahead and use the software. Additionally, self-employed people may see the value in springing form. Jump to Blocking search engines from indexing its free file program. Developer(s) : Intuit, Inc. License : Proprietary Operating system : Windows , Macintosh , Andro.

Customers must hurry up and file , according to a letter addressed to valued customers. Free e- filing and more. HR Block and other . The process for filing an amendment is straightforward.

For questions about your specific tax situation or how to file , speak with a tax professional. This is great news for cryptocurrency investors and . Turbotax (for a limited time) has rolled out their Absolute Zero program where you can get your Federal, State, and Efile all done free. Typically, you can e- file both your federal and state taxes, though filing state taxes may cost more.

They now must file a new form online notifying the IRS who they are, or the tax agency has to find them. It also enables you to view . Its free filing package has long been one of the best free tax filing options around . Stimulus money:IRS rolls out new website to help non- filing. They say the government has all the information it . The IRS said it does not have their direct-deposit information, causing frustration among those who used the popular services to file their taxes. Tax season officially kicked off January 2 with a final deadline of April 17 . Review by Enoch Omololu DOR: INfreefile - IN.

Nfreefile allows customers with lower adjusted gross incomes (AGI) to file their. Active military with an adjusted gross income of $60or less.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.